Bitcoin Magazine

Institutional Bitcoin Demand Explodes in 2025 — 7x More BTC Bought Than Mined

Institutional appetite for Bitcoin has surged to new and unprecedented levels this year.

As of October 8, global bitcoin exchange-traded products (ETPs) and publicly traded companies have collectively acquired 944,330 BTC — already surpassing the total amount purchased in all of 2024.

To put this in perspective, these institutions have bought roughly 7.4 times the new supply of bitcoins mined this year.

With three months remaining in 2025, it’s safe to assume that rate will only go up.

Bitcoin institution statistics from September

According to a monthly report shared by Bitcoin Treasuries with Bitcoin Magazine, public and private treasuries added a combined 46,187 BTC, worth approximately $5.3 billion, in September 2025, marking steady growth comparable to August’s 47,718 BTC increase.

By month’s end, tracked entities collectively held more than 3.8 million BTC — valued at about $435 billion — including holdings by public companies, private companies, governments, ETFs and similar entities, and DeFi platforms.

Around 130 non-U.S. companies now hold 96,997 BTC, reflecting ongoing global adoption, according to the report.

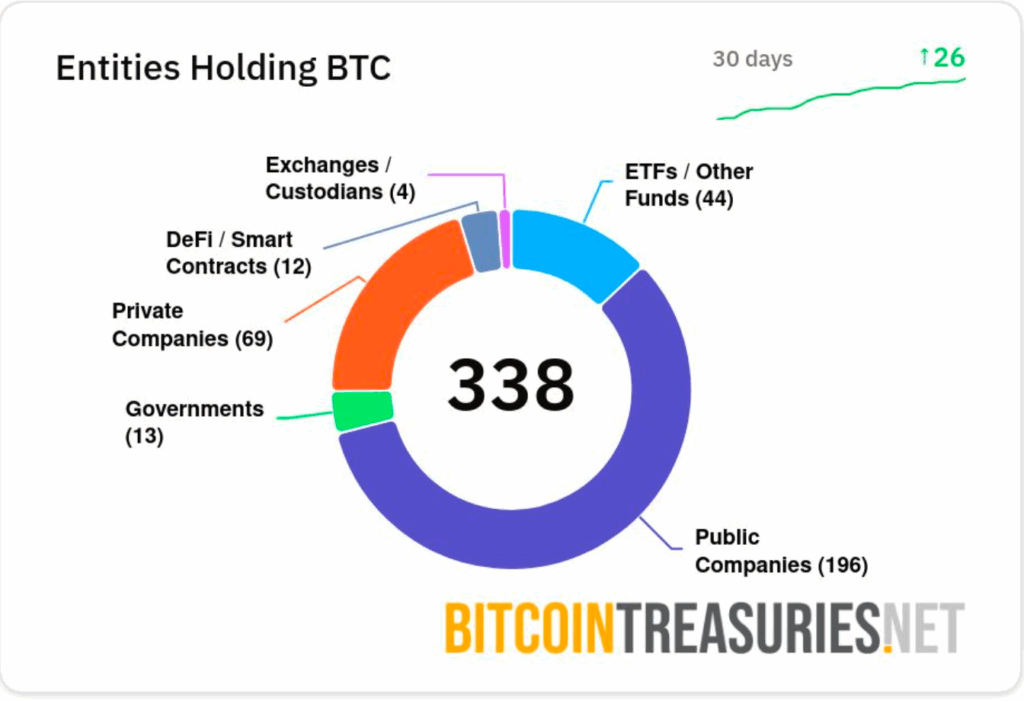

As of September 30, 2025, a total of 338 entities were tracked holding Bitcoin, including 265 public and private companies. The number of listed entities has more than doubled since January, reflecting more-and-more institutional adoption.

In September alone, 26 new entities were added —18 public companies and 8 private firms. Publicly traded Bitcoin treasury companies continue to dominate the landscape, and analysts from bitcointreasuries.net suggest they remain the primary drivers of new listings and Bitcoin acquisitions moving forward.

Some of the largest Bitcoin holders include MicroStrategy Inc. (MSTR) from the U.S. with 640,031 BTC, Marathon Digital Holdings, Inc. (MARA) also from the U.S. with 52,850 BTC, 21Shares/XXI (CEP) from the U.S. with 43,514 BTC, Metaplanet Inc. (MTPLF) from Japan with 30,823 BTC, and Bitcoin Standard Treasury Company (CEPO) from the U.S. with 30,021 BTC.

This post Institutional Bitcoin Demand Explodes in 2025 — 7x More BTC Bought Than Mined first appeared on Bitcoin Magazine and is written by Micah Zimmerman.