Bitcoin Magazine

Metaplanet Buys the Dip — Securing a Massive Bitcoin Position as Price Stays Below $112,000

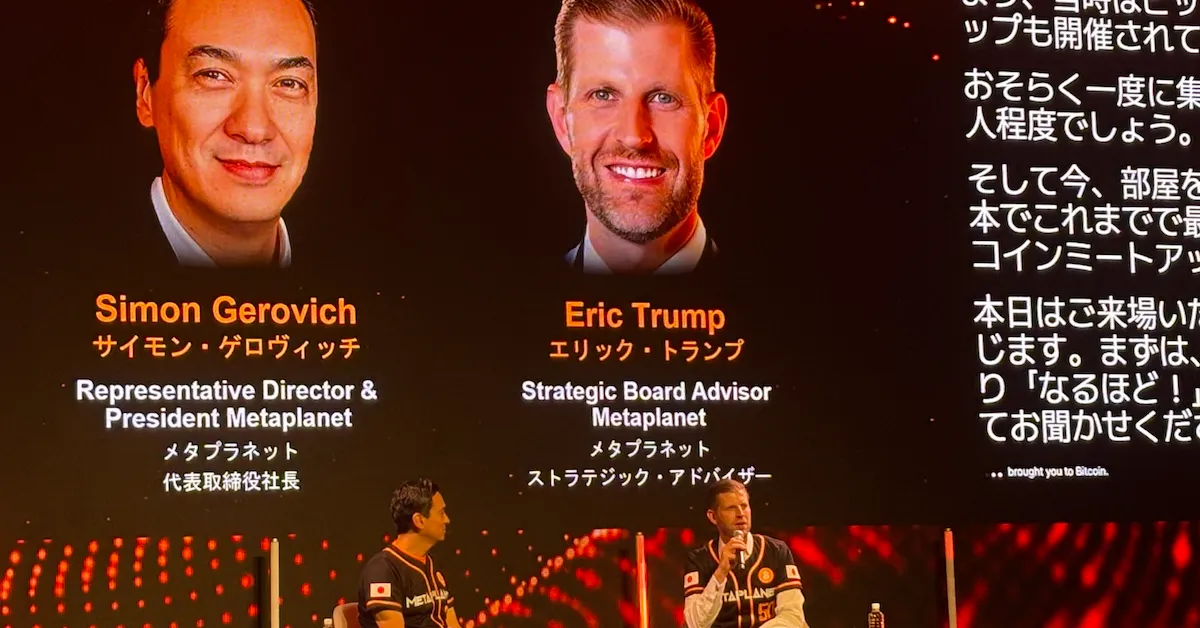

Japanese publicly listed giant Metaplanet has acquired an additional 136 Bitcoin worth approximately $15.2 million (¥2.251 billion), bringing its total holdings to 20,136 BTC, according to a filing with the Tokyo Stock Exchange on Monday.

The latest purchase, made at an average price of $111,666 (¥16.55 million) per Bitcoin, demonstrates the company’s aggressive accumulation strategy as it races toward its ambitious target of 100,000 BTC by 2026. Metaplanet has now invested a total of $2.08 billion (¥304.56 billion) in Bitcoin at an average Bitcoin price of $103,196 (¥15.13 million) per coin. The company’s rapid accumulation has positioned it as the sixth-largest public corporate holder of Bitcoin globally.

The firm has dramatically expanded its Bitcoin acquisition targets, having originally planned for just 10,000 BTC by 2025 and 21,000 BTC by 2026. The revised strategy now aims for 30,000 BTC by year-end 2025 and 100,000 BTC by 2026, reflecting growing institutional confidence in Bitcoin as a treasury asset.

Metaplanet’s accumulation strategy has proven successful, with the company achieving a “BTC Yield” of 487% year-to-date in 2025. This metric, which measures the percentage change in Bitcoin holdings relative to fully diluted shares, demonstrates the company’s ability to grow its Bitcoin position while managing shareholder dilution.

The trend of corporate Bitcoin adoption has accelerated dramatically in 2025, with over 200 public companies now holding Bitcoin in their treasuries. Collectively, these firms control more than 1 million BTC, representing over 4.5% of Bitcoin’s circulating supply.

Bitcoin treasury companies have become a significant force in the market. Their continued accumulation provides a strong buying base for the asset and could lead to substantial price increases if selling pressure diminishes.

To support its ambitious acquisition plans, Metaplanet recently secured shareholder approval for an $884 million capital raising initiative. The company has been actively managing its capital structure through a combination of equity issuances and bond redemptions, including multiple tranches of stock acquisition rights exercises throughout July and August 2025.

The emergence of Bitcoin treasury companies as a major market force represents a significant shift in corporate finance strategies. Recent entrants include American Bitcoin Corp., which began trading on the Nasdaq this week, and Strategy Inc., which added 4,048 BTC worth $449.3 million to its holdings last week.

The institutional adoption of Bitcoin as a treasury asset is accelerating faster than many anticipated. “Companies are increasingly viewing Bitcoin as a strategic hedge against currency devaluation and monetary uncertainty.

As the Bitcoin price continues to trade below $112,000, corporate treasury managers appear to be taking advantage of the relative price stability to build positions. With Metaplanet and other firms maintaining aggressive accumulation strategies, the competition for Bitcoin’s limited supply continues to intensify.

This post Metaplanet Buys the Dip — Securing a Massive Bitcoin Position as Price Stays Below $112,000 first appeared on Bitcoin Magazine and is written by Vivek Sen.