Bitcoin Magazine

Metaplanet Buys the Dip — Securing a Massive Bitcoin Position as Price Stays Below $113,000

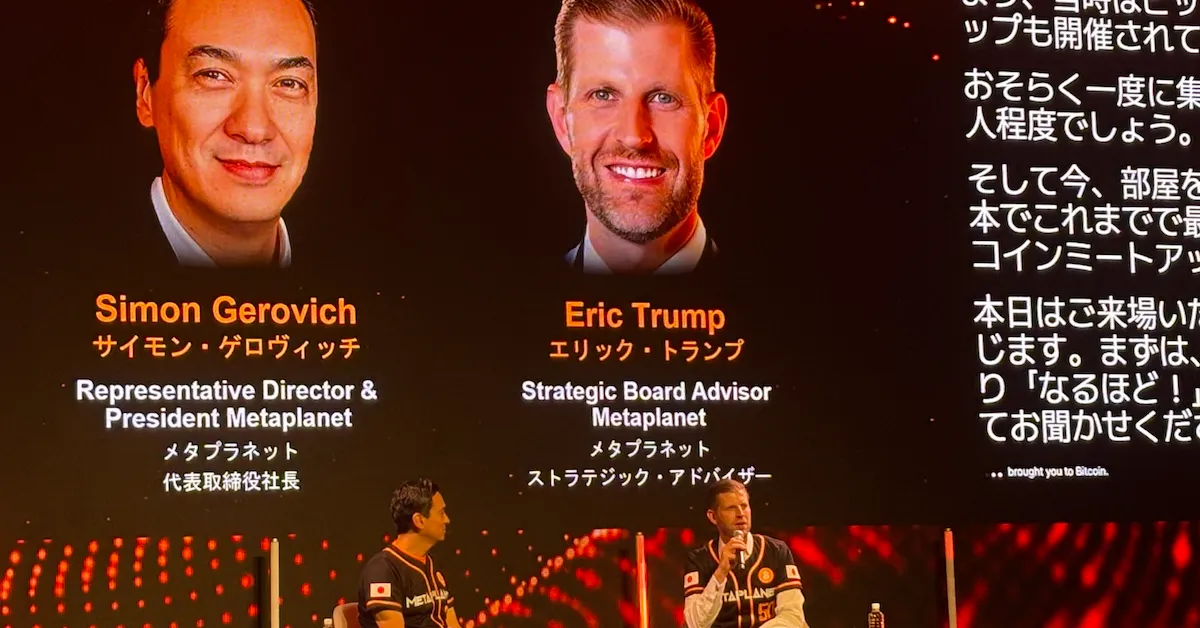

Tokyo-listed Metaplanet has acquired 5,419 Bitcoin worth approximately $632.53 million, making it the world’s fifth-largest corporate Bitcoin holder as the Bitcoin price hovers below $113,000.

The company purchased the Bitcoin at an average Bitcoin price of $116,724 per coin, according to a disclosure filed with the Tokyo Stock Exchange on Monday. The acquisition brings Metaplanet’s total holdings to 25,555 BTC, acquired for $2.7 billion, with an average cost basis of $106,065 per Bitcoin.

“Please note this purchase is just the first tranche!” Metaplanet’s head of Bitcoin strategy, Dylan LeClair, wrote on X (formerly Twitter), referring to the company’s recently raised $1.4 billion intended for Bitcoin acquisitions.

The purchase positions Metaplanet ahead of Bullish to become the fifth-largest corporate Bitcoin holder globally, trailing only Strategy, Marathon Digital, XXI, and Bitcoin Standard Treasury Company. The move comes as corporate Bitcoin treasury operations continue to expand rapidly, with new companies entering the space almost daily.

The latest acquisition represents significant progress toward Metaplanet’s ambitious targets, achieving 85.2% of its year-end 2025 goal of 30,000 BTC and advancing toward its 2026 target of 100,000 coins. The company has demonstrated strong performance metrics, with BTC Yield — a key performance indicator measuring Bitcoin holdings relative to fully diluted shares — reaching 95.6% in Q1 2025 and 129.4% in Q2 2025.

The purchase was primarily funded through proceeds from Metaplanet’s recent international share offering, which raised approximately $1.4 billion. Of the $1.25 billion allocated for Bitcoin purchases, the company has utilized about $632.53 million in this initial transaction.

The aggressive expansion of corporate Bitcoin holdings reflects a broader trend in the market. Corporate Bitcoin treasury holdings have now exceeded 1 million BTC, representing approximately 5% of Bitcoin’s circulating supply. This surge in institutional adoption has been particularly notable since the beginning of 2025, with companies like BitMine and Forward Industries joining the trend.

To support its growing operations, Metaplanet recently established Metaplanet Income Corp., a Miami-based subsidiary with $15 million in initial capital. The subsidiary will manage derivatives operations separately from treasury activities, enhancing governance and risk management. Despite the strategic acquisition, Bitcoin’s price has remained under pressure, trading below $113,000 after reaching recent highs above $117,000.

The company has also expanded its presence in Japan through Bitcoin Japan Inc., a new subsidiary managing media, events, and services related to Bitcoin, alongside the strategic acquisition of the Bitcoin.jp domain name.

As institutional adoption of Bitcoin continues to accelerate, the landscape of corporate treasury operations is evolving rapidly. With companies like Metaplanet leading the charge, the integration of Bitcoin into corporate balance sheets represents a significant shift in traditional treasury management practices, potentially setting new standards for institutional Bitcoin adoption.

This post Metaplanet Buys the Dip — Securing a Massive Bitcoin Position as Price Stays Below $113,000 first appeared on Bitcoin Magazine and is written by Vivek Sen.

Metaplanet buys 5,419

Metaplanet buys 5,419