The majority of Shiba Inu investors have been left confused about the crypto’s price trajectory in the past few weeks. While the crypto has experienced a period of stagnation in the past two weeks, recent on-chain data shows that the outlook might be looking bullish again, particularly as selling has slowed dramatically this week. At the same time, Shiba Inu has now crossed a major milestone in the number of addresses, which could mean an increase in the number of holders.

Shiba Inu Sell Pressure Drops

The price of Shiba Inu can easily be moved by selling and buying pressure from investors. Recent on-chain data, however, indicates that the selling pressure is currently decreasing, which could manifest in the price of the SHIB in the coming week. Particularly, IntoTheBlock’s historical active address by profitability shows the yearly average now shifting towards wallet addresses at the money.

Interestingly, this cohort of traders is now at almost 74.6%, meaning they contribute to the majority of the buying and selling action. However, their “at the money status” doesn’t give a clear path to their actions, as they could either be selling or increasing their holdings at the current price.

On the other hand, this metric indicates better action among the active portion of addresses that are “in the money.” Interestingly, these “in the money” addresses have now seen their year-to-date activity average falling below 18%. This cohort of traders, who would normally be selling after reaching profits on their holdings, have failed to conduct a tangible number of transactions. Interestingly, this indicates they might be opting to hold right now in order to increase their unrealized profits.

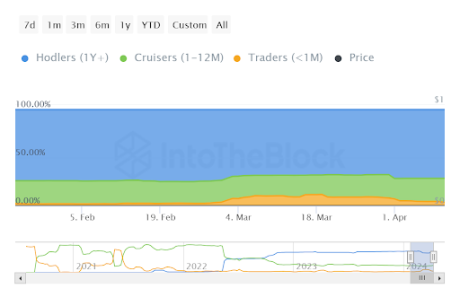

Similarly, on-chain data shows a substantial amount of SHIB moving out of the hands of short-term holders, contributing to a drop in selling pressure. About 4% of the entire circulating supply of SHIB has moved from short-term holders to mid-term holders in the past week. Mid-term holders hold their assets for more than a month to a year, in contrast to short-term holders, who are known for holding for less than a month before selling.

What’s Next For SHIB?

With decreasing sell pressure and a shift to longer holding times, SHIB is poised for a reversal and continued upward momentum. At the time of writing, SHIB is trading at $0.00002766, down by 1.1% in the past 24 hours and up by 4.65% in a larger 7-day timeframe.

Shiba Inu recently attained a milestone of 4 million addresses, which could mean an increase in activity is on the horizon. A surge in activity could see SHIB repeating a bullish pattern from the 2021 bull run. According to crypto analyst Bunchhieng, if history were to repeat itself, a repeat of this pattern would see SHIB rising to $0.0001.