Bitcoin (BTC), the largest cryptocurrency in the market, has seen its price hover between $42,000 and $43,000, halting its recovery from the dip below $38,500.

With the upcoming halving event scheduled for April, market experts and crypto analysts such as Rekt Capital are observing historical patterns that suggest an interesting price action scenario, potentially igniting another significant price surge for Bitcoin.

Pre-Halving Rally For Bitcoin Imminent?

Rekt Capital, known for its expertise in analyzing market trends, highlights the significance of historical patterns about previous halving events. These patterns reveal a consistent trend of substantial rallies leading up to the halving, followed by a short period of correction and consolidation before a major bull run and peak.

According to Rekt Capital, Bitcoin should commence its Pre-Halving Rally as early as next week if history indicates.

This rally, driven by investors “buying the hype” in anticipation of the halving, aims to capitalize on the price surge and realize profits by “selling the news.” Short-term traders and speculators often exploit this hype-driven rally and sell their positions.

The subsequent selling pressure contributes to a phenomenon known as the pre-halving retrace. This retrace typically occurs a couple of weeks before the actual halving event.

In previous halving cycles, the pre-halving retrace reached depths of -38% in 2016 and -20% in 2020. It is worth noting that this phase can last for several weeks, introducing uncertainty among investors regarding whether the halving will act as a bullish catalyst for Bitcoin’s price.

Overall, the historical patterns observed by Rekt Capital point to the possibility of a pre-halving rally in the coming weeks, followed by a correction period known as the pre-halving retrace.

While past performance is no guarantee of future results, these historical trends provide valuable guidance on how the price of Bitcoin may perform in the coming weeks and days before the halving.

Long-Term Holder Support And ETF Buying Pressure

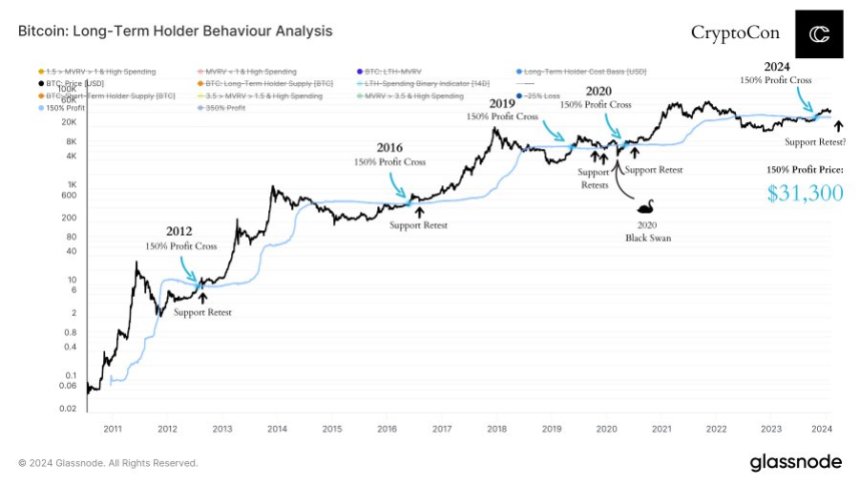

Despite expected short-term gains for BTC, Crypto Con has recently drawn attention to a historical trend in the Bitcoin market. According to Crypto Con, no Bitcoin cycle has ever escaped a retest of the 150% long-term holder support line.

According to the analyst, this line has acted as a crucial level of support during various market cycles. Even during the unprecedented black swan event and subsequent recovery in 2020, the price retested this line as support.

By analyzing this metric, Crypto Con suggests that based on historical patterns, Bitcoin’s price may need approximately $31,300 to retest the long-term holder support line.

The anticipated impact of ETF buying pressure on Bitcoin’s price is counterbalancing the argument for further corrections. Introducing ETFs (Exchange-Traded Funds) into the cryptocurrency market is a relatively new development. As such, the effects of ETF inflows on Bitcoin’s price remain to be seen and are a subject of ongoing observation.

While the potential retest of the long-term holder support line may create temporary price fluctuations, proponents of Bitcoin as an investment opportunity view such a scenario as a buying opportunity.

Ultimately, Crypto Con believes that those who believe in the long-term prospects of Bitcoin may choose to take advantage of any price dips resulting from a retest of support.

BTC trades at $42,800, up a slight 0.4% in the past 24 hours as of this writing.

Featured image from Shutterstock, chart from TradingView.com